AUSTIN, TX – March 25, 2025 – LeanDNA, today released additional findings from its survey conducted by Wakefield Research, focusing on the role of AI, digital synchronization, and proactive logistics in driving supply chain growth. The survey of 100 C-level U.S. executives and 100 U.S. supply chain leaders reveals strong agreement on the importance of these technologies but highlights continued divergence in risk perception.

AI: The Supply Chain’s Essential Ally

The survey underscores the growing recognition of AI's critical role in supply chain management. An overwhelming majority (92% of executives, 100% of supply chain leaders) agree that AI-driven insights are essential for predicting and preventing disruptions. Optimism for ROI is high, with most (87% of executives, 89% of supply chain leaders) expecting a positive return on AI and machine learning investments within one to two years. Notably, 39% of executives and 34% of supply chain leaders anticipate ROI even sooner.

C-Level executives are especially bullish on the immediate and near-term ROI from AI. In fact, executives are 60% more likely to say they have already seen positive ROI or they expect to in the next 6 months than supply chain leaders (24% of executives, 15% of supply chain leaders). We believe that this shows that the C-suite is even more ready and receptive to AI and is likely to put pressure on supply chain leaders to move faster.

Taking Action: AI and Synchronization Lead the Way

Supply chain leaders are actively leveraging AI and machine learning, with 50% citing it as a top strategy for improving reliability. Other key initiatives include diversifying the supplier base (45%), implementing supply network synchronization (39%), and upgrading data infrastructure (39%).

Getting In Sync: Progress Toward Digital Synchronization

Many companies are making strides toward full digital supply chain synchronization, with 57% of executives and 51% of supply chain leaders reporting steady progress. However, full synchronization remains elusive, achieved by only 19% of executives and 18% of supply chain leaders.

The Costs of Delaying Improvements: Diverging Concerns

Both groups acknowledge the risks of delaying supply chain innovations, including production disruptions, market fluctuation responsiveness, inventory costs, reputational damage, regulatory compliance, and competitive disadvantage. However, priorities differ. Executives are most concerned about production disruptions (53%), while supply chain leaders prioritize inventory costs (53%), reputational damage (53%), and regulatory compliance (50%).

Getting Ahead for Growth: Proactive Logistics Imperative

To maximize growth, companies must shift from reactive to proactive logistics planning. A majority of executives (77%) and supply chain leaders (78%) believe that their organization’s supply chain logistics need to be more proactive to maximize growth. Only a small fraction believe their logistics are already sufficiently proactive.

Key Takeaways:

- Shared Vision, Divergent Concerns: Both C-suite and supply chain leaders recognize the value of AI, digital synchronization, and optimization. However, they differ significantly in their concerns regarding the consequences of delayed improvements.

- Risk Alignment is Essential: Bridging the gap in risk perception and reducing friction between the two groups is crucial for accelerating growth.

- Proactive Planning Drives Growth: Shifting from reactive to proactive logistics planning is essential for navigating volatility and maximizing growth potential.

“The C-suite and supply chain agree that supply chain professionals and business leaders expect gains from investing in AI tools, digital synchronization, and optimization. However, it also shows that they differ in what they are most concerned about if improvements are delayed. Getting in synch on the risks and reducing friction between the two groups will allow their companies to grow faster.” Said Andy Ellenthal, CEO of LeanDNA.

The survey results are available on LeanDNA’s website, and a full report is also available for download.

METHODOLOGICAL NOTES

The LeanDNA Survey was conducted by Wakefield Research among 100 US C-levels, with influence over or oversight of supply chain decisions, with the following qualifying titles: CFO, COO, CSCO, and also among 100 US supply chain leaders, defined as supply chain, planning and inventory executives, with a minimum seniority of manager, working at discrete manufacturing companies, between February 3rd and February 11th, 2025, using an email invitation and an online survey. Results of any sample are subject to sampling variation. The magnitude of the variation is measurable and is affected by the number of interviews and the level of the percentages expressing the results. For the interviews conducted in this particular study, the chances are 95 in 100 that a survey result does not vary, plus or minus, by more than 9.8 percentage points in each audience from the result that would be obtained if interviews had been conducted with all persons in the universe represented by the sample.

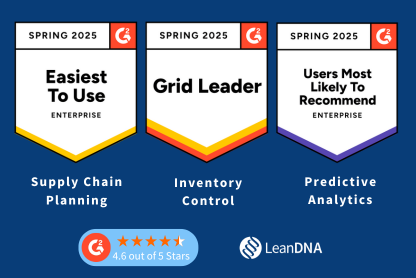

About LeanDNA

LeanDNA is a leading intelligent supply chain execution platform that enables supply chain teams with a single source of truth for inventory management and production readiness. This cloud-based platform synchronizes execution across the supply chain, empowering manufacturers to prioritize and collaborate to resolve critical material shortages and excesses. With LeanDNA, manufacturers improve on-time delivery and working capital levels by gaining visibility into current and incoming materials, actions based on inventory criticality, real-time collaboration with suppliers, and the ability to track progress toward inventory optimization goals. Learn more at LeanDNA.com.

Contact (For Media Only):

Jodi Bart Holzband

Classic Bart PR & Communications

jodi@classicbart.com