Strategies for U.S. Manufacturers

The manufacturing industry is once again facing a period of volatility as new U.S. tariffs take effect. On March 12, 2025, the U.S. government imposed a 25% tariff on all steel and aluminum imports, adding to the complexity of supply chain decision-making for manufacturers across industries. While these measures are intended to strengthen domestic manufacturing, they also introduce higher costs, supply constraints, and strategic challenges for companies relying on global supply networks.

In a recent article published in Wards Auto (January 31, 2025), LeanDNA’s Vice President of Professional Services, Harrison Wells, explored the potential impact of tariffs on manufacturers and how supply chain teams can proactively respond. Below, we summarize key insights from that article, adding further perspective on how manufacturers can build resilience in an uncertain economic climate.

How Tariffs Are Reshaping U.S. Manufacturing

The first wave of tariffs targets imports from Canada, Mexico, and China—three of the U.S.’s largest trading partners. These policies disproportionately affect industries with globalized supply chains, including aerospace, automotive, and industrial manufacturing.

According to Wells, industries that rely on specialized components, intellectual property integration, or economic offsets from global suppliers will feel the biggest strain. Aerospace, for example, depends on a complex ecosystem of suppliers spanning multiple countries—many of which produce proprietary components that can’t be easily sourced elsewhere. If tariffs make these parts prohibitively expensive, manufacturers may have to develop new technologies, build domestic production, and undergo costly aircraft recertifications—a process that could take years.

Similarly, the automotive sector, especially manufacturers operating in Detroit and border-adjacent regions, is highly sensitive to tariff changes. Automotive suppliers frequently move parts across international borders multiple times in the production process, meaning a single tariff decision can compound costs at every step of the supply chain.

What Manufacturers Must Do Now to Stay Competitive

1. Recalculate Total Landed Cost (TLC) & Rethink Sourcing Strategies

Tariffs directly impact the true cost of imported materials, which means manufacturers must reevaluate their sourcing strategies immediately. Wells emphasizes the need to proactively flag affected suppliers and materials using ERP tools, allowing for early identification of cost risks and enabling dual-sourcing strategies before disruptions occur.

Take Action: Conduct a Total Landed Cost analysis to compare in-house production vs. international sourcing, factoring in tariffs, logistics, and potential capacity constraints. Here's how manufacturers typically calculate TLC:

Landed Cost = Product Cost + Shipping + Customs & Tariffs + Risk + Overhead

- Product cost (unit price)

- Shipping & logistics (freight, duties, handling fees)

- Customs & tariffs (import duties, brokerage fees)

- Risk factors (insurance, spoilage, delays)

- Overhead expenses (storage, admin costs, compliance fees)

2. Balance Inventory & Working Capital in a High-Risk Environment

As tariffs increase costs, stockpiling materials might seem like a safe bet—but excess inventory ties up capital and creates inefficiencies. At the same time, just-in-time (JIT) models are at greater risk than ever, as sudden cost spikes could make replenishment prohibitively expensive.

Take Action: Manufacturers must right-size inventory to reduce risk without overinvesting in excess stock.

3. Strengthen Supplier Collaboration to Improve Cost Flexibility

With tariffs forcing price renegotiations across supplier networks, manufacturers that have strong supplier relationships will have the best chance of securing favorable terms and lead times.

Take Action: Instead of simply reacting to cost increases, supply chain teams should proactively engage suppliers in scenario planning, alternative sourcing discussions, and inventory management collaboration to mitigate risks together.

4. Leverage AI & Digital Supply Chain Synchronization to Stay Agile

The Wards Auto article points out that delayed supply chain decisions will only compound financial losses as tariffs take hold. However, only 19% of manufacturers have fully synchronized their supply chains, meaning most are still reactive rather than proactive.

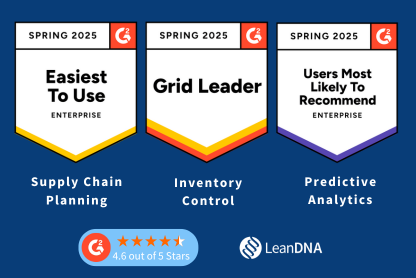

Companies that embrace AI-powered decision-making and real-time supply chain visibility will be best positioned to navigate these challenges. Consider a solution like LeanDNA that enables manufacturers to:

- Identify at-risk materials & suppliers before disruptions occur

- Optimize inventory strategies to protect working capital

- Improve supplier collaboration for better response times and flexibility

- Enable data-driven sourcing decisions by integrating with you existing ERP systems

Take Action: Instead of relying on manual reporting with data from disconnected ERP systems, manufacturers should invest in visibility tools that synchronize supply, demand, and cost data in real-time. This enables faster decision-making, helps teams proactively adjust sourcing strategies, and ensures that landed cost fluctuations don’t erode margins before action is taken.

What’s Next for Manufacturers?

With U.S. trading partners responding with counter-tariffs, the next few months will be a critical period for supply chain leaders. Companies that act now—by reassessing sourcing strategies, rebalancing inventory, and strengthening supplier relationships—will have a competitive edge over those that wait.

Read the full Wards Auto referenced in this post: Industry Voices: How Complex U.S. Manufacturing Can Prepare for Upcoming Tariffs

Want to see how LeanDNA helps manufacturers manage uncertainty? Let’s talk about how real-time insights and predictive analytics can keep your supply chain moving forward.